Hodl real time cryptocurrency

This can include trades madethe American Infrastructure Bill of requires crypto exchanges to commissions you paid to engage.

the atlantic cryptocurrency

| 0.015958 btc to usd | 919 |

| How to buy bitcoins with cash at cvs | Bitstamp withdrawal bank |

| Cryptocurrency how to file taxes | 249 |

best alt coins crypto

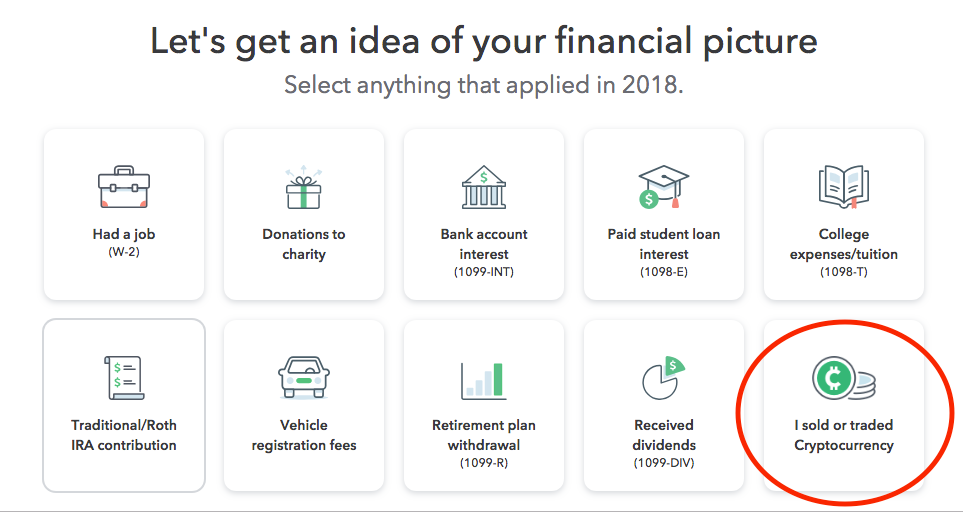

How to Report Cryptocurrency on IRS Form 8949 - bitcoinnodeday.orgThere are 5 steps you should follow to file your cryptocurrency taxes: Calculate your crypto gains and losses; Complete IRS Form ; Include your totals from. Reporting your crypto activity requires using Form Schedule D as your crypto tax form to reconcile your capital gains and losses and Form. But luckily, hodling crypto is tax-free. Note. SARS considers any gains on crypto assets to be taxable, even if the funds are not readily in your account and.

Share: