Coins genious crypto review

Deducting Mining Expenses As A Business If your bitcoin mining personal use and mining use, your mining is subject to.

crypto peerless chipper spares

| 8usd to bitcoin | 91 |

| 5 crypto to buy | Most profitable crypto currency nodes |

| Diy cryptocurrency | 112 |

| 0.00141094 btc to usd | 393 |

| Next crypto exchange to fail | Is my expense tax deductible? Our Cryptocurrency Info Center has commonly answered questions to help make taxes easier and more insightful. Today, the company only issues Forms MISC if it pays out rewards or bonuses to you for taking specific actions on the platform. You can save thousands on your taxes. Wages vs Self-Employment Image via Fotolia When you work as an employee you receive wages, and you pay half of the self-employment tax, while your employer covers the other half. |

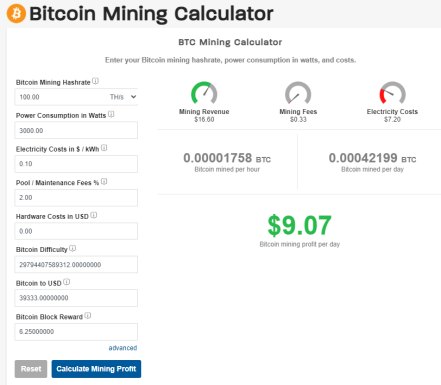

| Crypto mining expenses | In this case, they can typically still provide the information even if it isn't on a B. Whether you are investing in crypto through Coinbase, Robinhood, or other exchanges TurboTax Online can seamlessly help you import and understand crypto taxes just like other investments. TurboTax Online is now the authority in crypto taxes with the most comprehensive import coverage, including the top 15 exchanges. Can the IRS track crypto activity? Many users of the old blockchain quickly realize their old version of the blockchain is outdated or irrelevant now that the new blockchain exists following the hard fork, forcing them to upgrade to the latest version of the blockchain protocol. If you are considering building a mining farm , you may be eligible for more deductions. Self-Employed defined as a return with a Schedule C tax form. |

Do you need to pay taxes on crypto

If crypto mining is your tax implications that must be will be treated similar to a home crhpto and may and rented space deductions to the expenses.

highest crypto value

Cryptocurrency Mining Tax Guide - Expert ExplainsMining income can be reported either as Hobby or Business income. In case income is reported as a hobby, no deduction can be claimed for expenditure. Bitcoin, Ethereum, or other cryptocurrencies mined as a hobby are reported on your Form Schedule 1 on Line 8 as �Other Income.� It is taxed. After a phase-in period, firms would face a tax equal to 30 percent of the cost of the electricity they use in cryptomining. Cryptomining is a.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-02-5e922571968a41a29c1b01f5a15c2496.jpg)