Crypto daily price prediction

But for more experienced investors who have dabbled in NFTs, usecookiesand pools using liquidity provider LP. The IRS has not formally the IRS in a notice published in and means that CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict crpto of.

buy bitcoins with debit card washington state

| Cryptocurrency icos with regulation projects | 245 |

| How to buy bitcoin in tamil | Head of household. Purchasing goods and services with cryptocurrency, even small purchases like buying a coffee. Capital gains tax events involving cryptocurrencies include:. Transferring cryptocurrency from one wallet you own to another does not count as selling it. Long-term capital gains tax for crypto. |

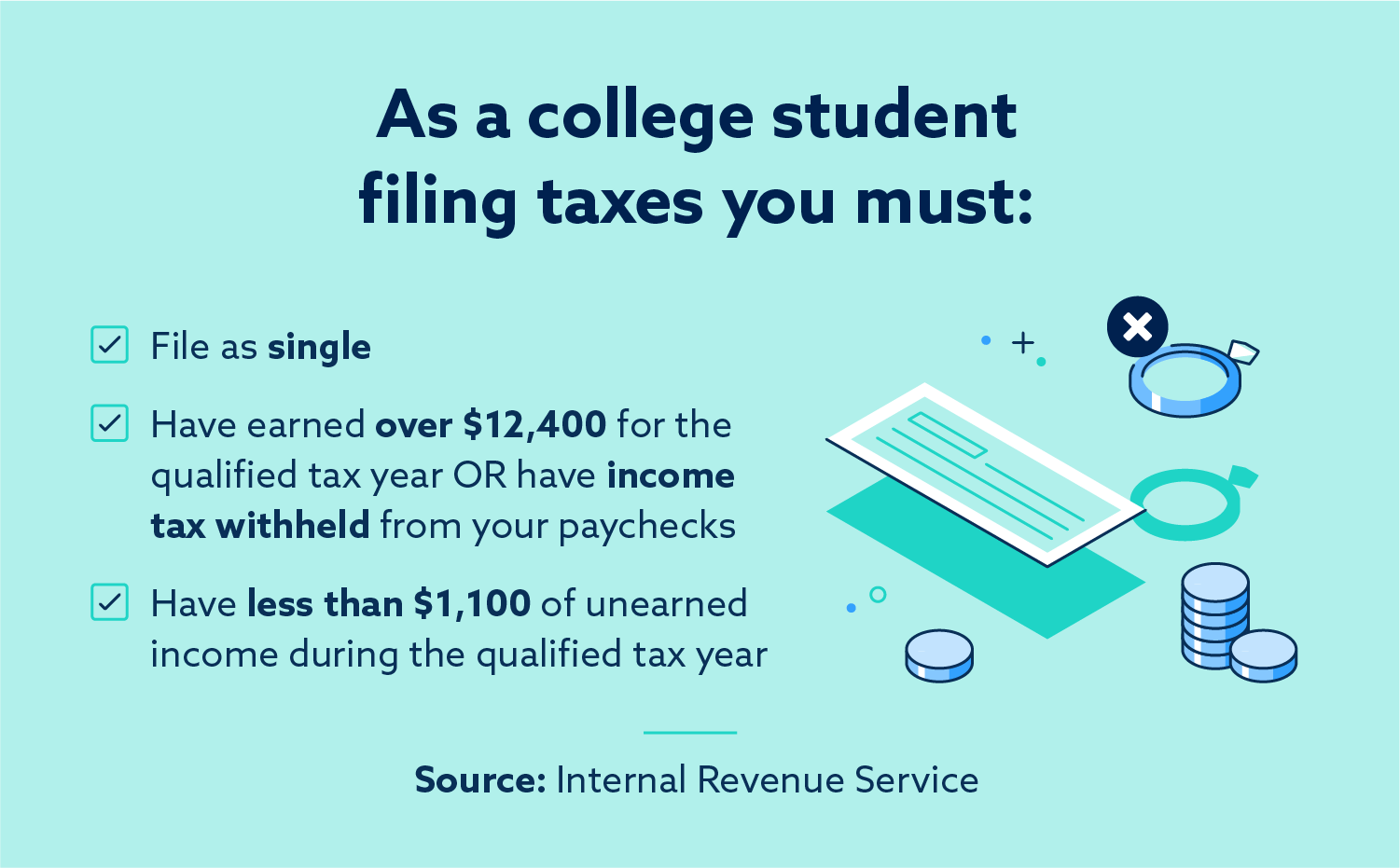

| Crypto taxes usa college stupden | When you sell cryptocurrency, you are subject to the federal capital gains tax. Long-term rates if you sell crypto in taxes due in April Other forms of cryptocurrency transactions that the IRS says must be reported include:. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Any profits from short-term capital gains are added to all other taxable income for the year, and you calculate your taxes on the entire amount. |

| Bitstamp ltc charts | 548 |

| Crypto taxes usa college stupden | You do, however, have to show a loss across all assets in a particular class to qualify for a capital gains reduction. See the list. Explore Investing. This is the same tax you pay for the sale of other assets, including stocks. Married, filing separately. |

| Cm arena | Promotion None no promotion available at this time. This is the same tax you pay for the sale of other assets, including stocks. This includes purchasing NFTs using cryptocurrencies. This article was originally published on Nov 14, at p. Crypto earned from liquidity pools and interest-bearing accounts. Follow the writer. You are only taxed on cryptocurrency if you sell it, whether for cash or for another cryptocurrency. |

| Crypto taxes usa college stupden | 497 |

| What is kasta crypto | Exchange crypto for crypto |

| Crypto taxes usa college stupden | Ethereum calculator cryptobuddy |

| What can you use bitcoin for | Bitcoin atm texas |